In This Blog

- Common pricing of rehab throughout Florida

- Factors that influence the cost of overall programs

- Essentials with respect to insurance cover and checklist

- Out-of-pocket expenditures, options for payment

- Budgeting tips and comparison tips

The expenses of rehab and insurance packages may be confusing at some point in time, particularly when there are so many others in the marketplace based on location, service, and treatment length. This guide encompasses the issue of price scales, cost drivers, and a typical engagement of the insurance schemes and rehab services. Clarity rather than persuasion is the aim, thus readers can make an assessment based on evidence keenly.

The rehab programs in Florida are enormous and include both short-term programs where the patient receives expert outpatient services, as well as long-term residential programs. Examples of costs are staffing, facilities, life span of stay, and support.

Insurance cover is given to cover the charges, with the benefits provided on the insurance scheme and network. One way these elements fit together is how individuals and families mindfully plan what they want to do and be unsurprised, and ask informed questions as they browse programs.

Understanding Rehab Cost Ranges in Florida

Rehab pricing in Florida is extremely different. Daily or monthly rates are dependent upon program structure, setting, and the services that are included. Shorter and less intensive courses and experiences are also likely to be much less expensive, whereas longer and immersive programs are more expensive.

Typical Cost Estimates

Program Type | Common Duration | Approximate Cost Range |

Outpatient | Several weeks | $1,500–$5,000 |

Intensive Outpatient | 4–12 weeks | $3,000–$10,000 |

Residential | 30 days | $6,000–$25,000+ |

Extended Residential | 60–90 days | $12,000–$60,000+ |

These numbers are averages and are not actual prices. Programs may contain bundles of services in various ways, and this has implications for the overall cost. Comparing things that are included helps to make accurate evaluations.

Contact Solutions Healthcare for Detailed Rehab Guidance

Key Factors That Influence Pricing

There are a number of variables that affect the price of rehab, along with the type of program. Understanding these factors helps to understand the cost from one provider to another.

Length of Stay

Longer stays have a higher cost; however, there are some programs that have lower daily rates for longer stays.

Staffing and Expertise

Programs that have a team of multi-disciplinary individuals, smaller groups, or may be specialized training are usually more costly due to the expenses of operations.

Amenities and Environment

Private rooms, wellness facilities, and resort-style environments increase the costs, and basic ones decrease the costs.

Support Intensity

More frequent on one or arranged daily schedules are often more expensive than flexible models in terms of price.

Expert Advice: Compare total costs, coverage limits, and included services before choosing.

Insurance Coverage Basics for Rehab

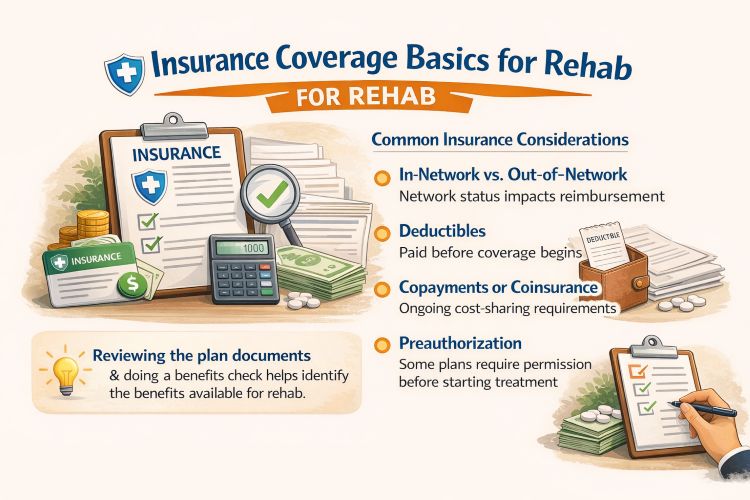

Insurance can help tremendously in terms of reducing out-of-pocket expenses, but the coverage for this is not always the same. Most plans cover rehab as behavioral health benefits with the requirement of deductibles, copays, and/or network requirements.

Common Insurance Considerations

- In-network vs. out-of-network: The Status of being in the network has an impact on reimbursement.

- Deductibles: Amount paid before the beginning of the coverage.

- Copayments or coinsurance: Having an impact on continuing cost-sharing requirements.

- Preauthorization: With some plans, it is required to get permission to initiate the services

Reviewing the plan documents and a benefits check can help get details on the benefits, which may cover some of the things you’ll need to accomplish early on.

Verifying Insurance Coverage Step by Step

Checking the coverage before enrollment is one way of not having to pay for something that you did not think of. A structured approach helps in better accuracy.

- Request a benefits verification: Give the information about the insurance to the provider.

- Confirm network status: Check whether the services are in the network.

- Review covered services: Understand what the plan reimburses.

- Ask about cost-sharing: Make sure you understand in reference to deductibles, copays, and coinsurances.

- Request written summaries: Documentation supports transparency.

Out-of-Pocket Expenses to Expect

Even with an insurance policy, there are expenditures to be incurred. Awareness contributes to realistic budgeting.

Expense Type | Description |

Deductible | Amount paid before start of coverage |

Copayment | Fixed fee per visit or service |

Coinsurance | Percentage of total cost |

Non-covered services | Offers Which Are Optional or Where the Offer is Made of the (Exclusion) |

These things can be discussed before reducing uncertainty.

Contact Solutions Healthcare to Discuss Coverage and Options

Payment Options Beyond Insurance

Where coverage for these services by insurance is limited, other ways of payment may be helpful.

Self-Pay Discounts

Some providers charge a better price for payment in advance or cash.

Payment Plans

Installments stretch out costs over time to reduce an immediate monetary strain.

Third-Party Financing

Financing companies would possibly provide a structured type of return on their loans, and this is subject to approval.

Comparing total repayment amounts helps evaluate affordability responsibly.

Comparing Programs Effectively

Price, however, is not the only consideration to be reckoned with when making decisions. Evaluating the complete value requires a very balanced comparison of many things.

Questions to Ask

- What services are covered in the quoted price?

- During the participation in the process, how is the progress facilitated?

- Are there aftercare resources provided in the program?

- What are the other expenditures that you can incur?

Authentic answers help to improve choice.

Budgeting Tips for Planning Rehab

Making a clear budget makes it possible to draw an alignment between resources and expectations.

- Estimate total cost using verified insurance information.

- Include the living expenses in participating.

- Include possible follow-up support cost.

- Hold emergency funds if there is an unexpected need

Planning helps in reducing stress, and it helps in sustained engagement.

FACT: Insurance coverage varies widely; verification prevents unexpected financial responsibility.

Choosing a rehab program is not just a matter of price comparison, as it also involves finding a good fit between personal goals, support, and financial realities. Clear and comprehensible cost information, advice on insurance, and flexible means of payment can help to make it easier to choose plans. Exploring the options with educated professionals supports confidence, making educated choices without the stress and pressure.

Medical Disclaimer: This blog is for informational purposes only and is not a substitute for professional medical advice.

Key Takeaways

- The cost of rehab in Florida depends on the type of programs, duration of the rehab, and services.

- Insurance coverage can reduce expenses but requires verification.

- Out-of-pocket costs often incorporate deductions as well as copayments.

- Payment plans and self-pay options may improve affordability.

- Comparing value, not just price, is the means to better decisions.

FAQs

1. How much does rehab typically cost in Florida?

Rehab costs in Florida range widely based on program type, duration, and included services. Outpatient options often cost less, while residential stays cost more. Reviewing what each price includes helps clarify value and prevents inaccurate comparisons between programs offering different support levels.

2. Does insurance usually cover rehab services?

Many insurance plans include coverage for rehab services, but benefits differ by provider, network status, and plan design. Deductibles, copayments, and preauthorization requirements often apply. Verifying benefits in advance ensures clearer expectations regarding coverage limits and personal financial responsibility.

3. What expenses might not be covered by insurance?

Insurance may exclude certain services, amenities, or extended stays. Common uncovered costs include optional wellness activities, private accommodations, or non-standard support offerings. Asking providers for a detailed cost breakdown clarifies which expenses may require out-of-pocket payment.

4. Are payment plans commonly available?

Many rehab providers offer payment plans or financing options to help spread costs over time. Terms vary by provider and financing partner. Reviewing interest rates, total repayment amounts, and payment schedules supports responsible budgeting and prevents future financial strain.

5. How can programs be compared beyond price?

Effective comparisons include services, staff experience, support intensity, and aftercare resources. Transparent explanations, clear cost structures, and realistic expectations provide better insight than price alone, supporting choices aligned with individual needs and available resources.